What We Offer

End-to-End Lending Automation

From customer onboarding and KYC to credit assessment, disbursement, and collections — our platform streamlines every stage of the loan lifecycle.

Omnichannel Experience

Enable borrowers to access loans anytime, anywhere through mobile apps, web portals, chatbots, or in-branch kiosks.

Regulatory Compliance & Reporting

Stay ahead of evolving compliance standards with real-time reporting, audit trails, and built-in regulatory checks.

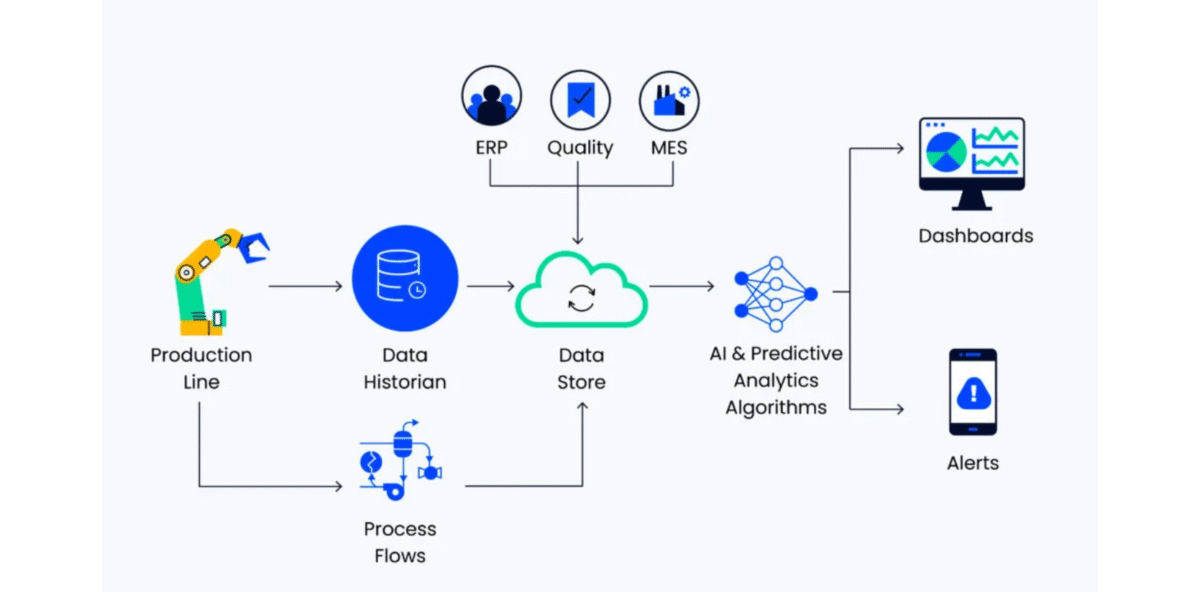

AI-Powered Credit Decisioning

Leverage advanced data analytics and machine learning to evaluate creditworthiness, reduce risk, and improve approval times.

Scalable Architecture

Whether you’re serving a niche segment or a national customer base, our cloud-ready platform scales with your growth.

Why Choose Us

Deep Domain Expertise

With deep roots in the fintech and BFSI space, we understand the nuances of digital lending.

Customizable Platforms

We tailor solutions to your lending model — be it personal loans, MSME, BNPL, gold loans, or education finance.

Faster Time-to-Market

Our low-code architecture and ready-made APIs help you go live quickly.